The 2025 Guide to Pre-Seed Funding for Early-Stage Startups

Starting a business is thrilling, but turning a dream into reality takes more than just passion. Most early-stage founders run into the same challenge. They need funding before their business can really get off the ground. That is where pre-seed financing comes in. It is the first capital you use to build your product, test the market, or hire your initial team.

So, if you are wondering, “What is pre-seed?” or “What does pre-seed mean?” think of it as your very first financial step toward building something great. In this article, we will break down how pre-seed investment works, from where to find it to what it takes to raise your first round in 2025.

What Is Pre-Seed Funding? A Simple Definition

Pre-seed funding is the first money a startup raises prior to getting a genuine product out to market or generating revenue. Your business is still an idea or an early prototype at this point. Your aim is to create something rudimentary, validate your idea, and prepare for the next round.

Pre-seed capital is usually provided by founders, family and friends, or early angel investors. It pays for things such as product development, legal establishment, or the initial employee hire.

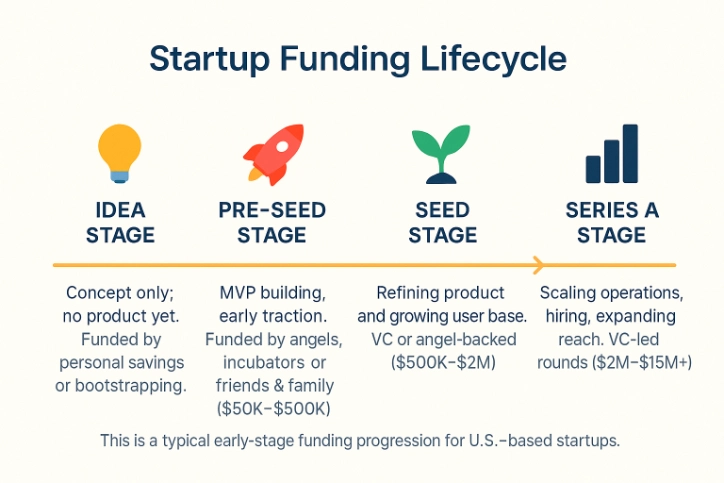

Where Pre-Seed Fits in the Startup Journey

Here’s a quick look at how pre-seed funding for startups compares to later stages:

| Stage | Funding | Company Status | Main Goal |

| Pre‑Seed | $50K–$500K | Idea or prototype | Build and test MVP |

| Seed | $500K–$2M | MVP and early traction | Grow team and product |

| Series A | $2M–$15M+ | Revenue and PMF | Scale and expand |

Why Pre-Seed Capital Matters in the Startup Lifecycle

Pre-seed funding is the first money a startup raises prior to getting a genuine product out to market or generating revenue. Your company is still an idea or an early prototype at this point. Your aim is to create something rudimentary, validate your idea, and prepare for the next round.

It Helps Turn Ideas Into Action

Pre-seed capital is usually provided by founders, family and friends, or early angel investors. It pays for things such as product development, legal establishment, or the initial employee hire.

It Supports the Essentials

Initial investment generally covers:

- Creating an MVP (minimum viable product)

- Hiring your first employee or contractor

- Bringing in early user testers or market researchers

- Covering legal or tech setup costs

You Can Shape and Adjust Your Direction

It is only logical now to shape or even change your direction. The pre-seed capital flexibility enables you to experiment, learn, and refine. It also gives you room to start building your business plan and positioning yourself for future rounds.

Investors Want to See Growth Potential

Even as a stage-one startup, investors will be curious about how your product idea has the potential to grow. That is why showing progress toward a scalable business model is crucial. It is where your solution reaches more people or generates more revenue without incurring major costs.

It Builds Momentum

A mobilized pre-seed round lays the foundation for everything that follows. With the right approach, you can build trust, grow your network, and position yourself for the seed stage.

Main Sources of Pre-Seed Funding

These are the most common sources of investors funding startups at the pre-seed stage:

Angel investors

These are seasoned entrepreneurs or business professionals who invest their own capital. They tend to provide advice and valuable connections, along with funding.

Family and friends

Most founders start off with the help of someone they know and trust. Although this tends to be informal, it goes a long way toward getting your concept off the ground.

Micro venture capital firms

These are small VC firms that invest specifically in seed-stage businesses. They’re more likely to invest when you haven’t yet made much revenue or traction.

Startup accelerators and incubators

You receive cash, mentorship, and access to a network, in exchange for equity, through programs like Y Combinator or Techstars.

Crowdfunding platforms

If you have a solid idea and can build buzz online, then platforms like SeedInvest or Republic can help fund your pre-seed round through the crowd.

Top 5 Micro VCs in the US

If you are looking for serious pre-seed fundraising from serious players, the following micro VCs are well worth your time:

- Unshackled Ventures – unshackledvc.com

- Precursor Ventures – precursorvc.com

- Banana Capital – bananacap.com

- Bloomberg Beta – bloombergbeta.com

- First Round Capital – firstround.com

How to Get Pre-Seed Funding in 2025

If you’re building a startup, raising money early is a challenge. Pre-seed funding gives you the first push. Here’s how to get started.

1. Make Sure Your Idea Solves a Real Problem

Don’t pitch too early.

First, talk to people. Ask them what they struggle with. Then build something simple that helps. It doesn’t have to be perfect—just usable.

A basic prototype can show that you’re serious.

2. Put Together a Strong Pitch

Your pitch should be clear.

Say what the problem is, how you’re solving it, who it’s for, and why it matters.

You don’t need a long business plan. Just explain your idea in plain terms.

Investors want to know what makes you different.

3. Find the Right People

Look for investors who fund companies like yours.

You can use tools like

- LinkedIn

- Crunchbase

When you reach out, keep it short. Show how you plan to grow. A basic marketing plan helps.

4. Reach Out with a Personal Touch

Don’t send the same message to everyone.

Look up the investor. Know what they like to fund.

Then send a short, personal email.

Say why you’re reaching out, what you’re building, and why it fits them.

Attach a short pitch deck. Make it easy to skim.

5. Follow Up and Keep Building

Most investors won’t say yes right away.

That’s normal.

Keep them in the loop. Share updates.

Show real progress—even small wins count.

Keep it short and professional. Let your work speak.

Bonus: Free Pre-Seed Checklist

Use the pre-seed checklist to stay focused while raising your first round.

Pre-Seed vs Seed vs Series A: The Key Differences

Getting a startup off the ground means moving through a few key stages of funding. Each one plays a different role, with different goals and investor expectations.

Pre-seed capital is where most founders start. This is the money that helps you get your idea off paper. Maybe it goes toward building a basic prototype or bringing on a first hire. A lot of the time, this stage is funded by friends, family, or maybe an angel investor or small VC willing to take an early bet.

Seed funding comes in once there’s a little traction. You might have a working version of your product or some early users showing interest. At this point, investors are looking for potential signs that this could grow into something big. The funds usually go toward hiring a few more people, polishing the product, and getting it in front of more users.

Series A is for startups that are past the early scrappy phase. Investors now want to see growth that’s not just possible, but already happening. You need a clear market, some momentum, and a real plan for scale. This is when startups build out their teams, focus on bigger growth, and start growing into their brand.

Still figuring things out? It’s totally fine to look at other ways to fund your idea before you start giving up equity.

The better you understand where you are in this journey, the better your chances of pitching the right people with the right message.

Pre-Seed Funding in the US: Key Stats (2024–2025)

| Metric | Data/Trend |

| Average pre-seed round size | $400,000 |

| Time to raise a round | 3–6 months |

| Top cities for pre-seed deals | San Francisco, New York, Austin, Miami, LA |

| % of rounds with angel investors | 61% |

| % of pre-seed startups bootstrapping | 72% |

| Share of deals via accelerators | 18% |

| Share of climate tech in pre-seed rounds | 13% (up from 7% in 2022) |

| Median startup valuation (pre-seed) | $3.2 million |

| Typical monthly burn post-raise | $15K–$35K |

| Pitch deck views before meeting | 80–100 |

| Investors contacted per round | 70–100 |

| Total US pre-seed funding (2024) | $720 million (from ~1,900 deals) |

Top Pre-Seed Funds and Investors in the US (2025 Edition)

Having a great investor at the pre-seed level makes all the difference. If you are iterating on your business model, testing a market, or building a product, pre-seed investors provide more than capital. They provide networks, expertise, and long-term value that can set your startup up for success.

Below are some of the most active and founder-focused pre-seed investors in the United States right now:

Afore Capital

Afore invests in pre-revenue and pre-product startups with checks as small as $1 million. They invest in first-time founders and support them with their platform.

Hustle Fund

Hustle Fund invests early and moves fast. They invest in scrappy teams with big ideas and respond to them within days. They also offer a founder community.

Techstars

Techstars offers seed and pre-seed funding through its global accelerator programs. They pair capital with mentorship and a big network of startups.

Find Out About Techstars Programs

Precursor Ventures

Precursor invests in early founders entering under-represented or underserved markets. Their approach is straightforward and founder-driven.

XYZ Venture Capital

XYZ invests in enterprise software, health startups, and fintech. They believe in transparency and like to invest early so that the founders get to grow at a faster scale.

Do this slowly and go through what each fund is interested in prior to reaching out to them. All of these US micro VCs have application forms or pitch portals on their sites, so ensure your deck is spotless and pitched towards their mandate.

Mistakes Founders Make in Pre‑Seed Fundraising

Pre-seed fundraising is fun, but it’s also when most early founders make rookie mistakes. However, the key is to recognize what to be cautious of.

Some of the most frequent ones are the following:

Pitching Without a Clear Vision

Investors require more than a fantastic idea. They’re searching for a plan, an understanding of your customers, and a growth strategy. If your presentation is garbage or doesn’t make any sense or meanders around, they’ll go elsewhere.

Trying to Reach Every Investor

Not all investors will be a good match for your company. Don’t waste your time calling everyone you can find. Contact investors who have invested in businesses similar to yours or a related line of business. It is more personal and more likely to receive a callback.

Ignoring Investor Feedback

If some investors repeat the same questions, listen to them. Pay close attention. Take their feedback and use it to refine your pitch, adjust your numbers, or clarify your model. Listening and flexibility demonstrate that you are receptive to new learning opportunities.

Skipping the Basics

Ensure that your foundations are solid before you venture out to raise investors. You must have your product, market, and business plan readily available. In the absence of those, it reflects that you are not prepared. You can even go ahead and discover the top reasons why startups fail so that you can do better.

Real-Life Pre-Seed Startup Case Studies

Seeing other startups close their seed round affects your startup’s potential and reality. Here are two US examples of startups that have successfully raised pre-seed funding, along with the reasons behind their success.

Example 1: GrowFlow

GrowFlow is a company that assists cannabis companies with their operations, from inventory management to compliance and beyond. They pre-seeded around $250,000 from angel investors with experience in the legal cannabis industry in the early months of 2024. A working product, a niche market, and experienced founders initially contributed to their success. Their vision and experience as founders were valued by their investors.

Example 2: Claira AI

Claira is a New York-based AI startup that managed to raise nearly $ 400,000 in 2025 from a combination of micro VCs and angels. The founders were exploring skills intelligence for talent acquisition, a segment that investors and HR professionals had become comfortable with. They had a solid pitch deck, an MVP live, and some early pilot customers, which was paramount in demonstrating real market traction.

These early victories were not perfect, but they demonstrated sufficient traction, vision, and conviction that persuaded others to join in.

Pre‑Seed Trends to Watch in 2025

The pre-seed financing landscape is undergoing rapid changes in 2025. Founders who possess knowledge of emerging trends have a superior opportunity of securing the support needed to establish and develop their startups.

Artificial intelligence is shaping products and investor decisions.

AI continues to reign supreme over the startup scene. Investors are not only funding AI products, but are also employing AI tools themselves. They enable them to sift through pitches more quickly and effectively. That implies that your pitch must be well structured, bite-sized, and to the point—even if no in-person meeting is involved.

Climate tech startups are gaining early traction.

There is a growing demand from investors for climate solutions. Clean tech, green process, and environmental tech startups are seeing growing pre-seed traction. Most micro VCs are actively seeking founders who are addressing climate issues.

Async pitching is becoming a standard.

Investors discover that they are more willing to listen to recorded pitches. Entrepreneurs are leveraging short videos and voiceover pitch decks to attract more investors without the need for scheduled calls. A quality digital pitch will enable you to receive faster feedback and earlier interest.

Keeping ahead of these trends will serve you well in your strategy alignment, cutting to the chase, and securing your first round of funding in 2025.

Tools and Resources to Assist Pre‑Seed Startups

Each founder needs a solid toolkit when preparing for pre-seed funding. Whether you’re refining your pitch or building your investor list, the right resources can save hours and boost your chances of success.

Pitch deck templates that guide your story

You need a strong pitch deck. Use early-stage startup templates that focus on the problem-solution fit, simplicity, and market opportunity. These give you direction without overwhelming investors with unnecessary slides.

Need help preparing your pitch?

Download the free pre-seed pitch deck template from Founding Startups. It’s designed specifically for early-stage founders with little traction.

Investor CRM tools to manage outreach

It’s hard to keep track of who you’ve pitched and who replied. Tools like Affinity, Streak, and Folk help organize your investor pipeline. These CRMs support follow-ups, manage warm intros, and keep your fundraising on track.

Financial and business planning tools

Before pitching, make sure your projections and lean business model are ready. Tools like LivePlan, Causal, or Google Sheets templates give you a structure for building your early financials.

Final Wordings

Pre-seed money can help turn your concept into a business. It is well-suited for a solid-idea entrepreneur with early traction who needs to establish or prototype their product. Pre-seed money is all about potential, rather than profits.

It is not independent. The majority of startups typically begin with personal funds, grants, or accelerator funding. Select what works best for your intention and phase. If you are pre-seed ready, take a glance at our free resources, pitch deck templates, and investor lists to get started confidently.